Sheet Financing

Funding Waterfall

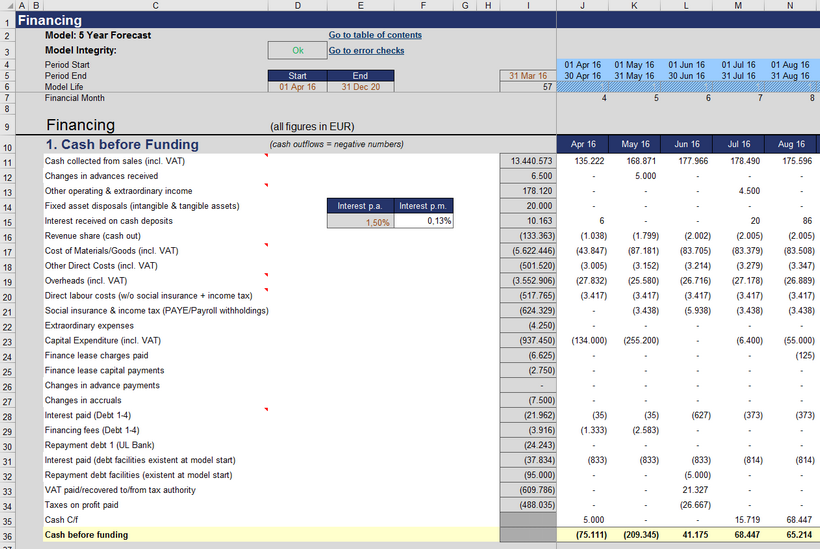

The “Financing” sheet is for funding input and calculations. The main section of the sheet is related to the funding waterfall, an ordered cascade of equity and debt draws with alternative funding priority.

In the top section (“cash before funding”) the monthly cash flow is calculated. Only in case of a deficit, additional cash (= funding) is required (amount to be funded = uses).

The second section (“financing”) consists of the actual funding waterfall. The various capital funding elements (= sources) are used in the following order: Equity first, followed by debt 1 to 4 and in a final step the overdraft facility.

An error message indicating insufficient funding will show, if cash after funding (and optional dividend payout) is negative.

Before you plan or optimize your funding structure you should finalize all other inputs (sales, human resources, costs, and capex) and also fill in principal repayments and interest payments for the debt facilities at model start (entered in the opening balance on the “Inputs” sheet). Principal and interest payments for these liabilities can be planned on the “Financing” sheet in rows 144 onwards. This is important as these payments may influence your pre-funding cash.

|

Example Let’s exemplify some options you have to optimize your financing structure: At the first stage of the funding cascade, you have several options. The full amount entered on the “Inputs” sheet may come in in the first month (if the corresponding option is selected), or on a cash-needed basis until the maximum is reached. If additional funds are required (subtotal < 0) the automatic debt 1 may kick-in (if activated on the “Inputs” sheet). Be aware that two conditions must be met for successful drawdowns. 1. There must be still capital available for funding deficit cash flow (depends on your inputs regarding maximum facility limit); 2. The deficit must fall within the drawdown period (depends on your inputs regarding drawdown period, both on the “Inputs” sheet). If additional funds are required (subtotal < 0) debt 2 can be utilized. Any drawdowns can be entered manually in the corresponding input line. Enter any repayments in the line below (as negative values). In case you have selected automatic interest calculation no further inputs are required, if not, manually enter interest payments (and financing fees, if applicable) below the corresponding balance sheet account (row 114 onwards). Debt 3 and 4 can be used in the same way. Last but not least the overdraft facility will automatically try to fund any deficit cash flow left, provided you have entered a maximum amount on the “Inputs” sheet and there is still overdraft capital available. |

Enter any dividend in line 75. An error message will show, if dividends exceed cash available.

In case any debt repayments are financed partly or wholly by using the overdraft facility a warning message will appear in the respective period (line 78). This is not an error in the narrow sense, but in some cases, it is possible to shift repayments and therefore avoid (further) drawdowns of the most expensive overdraft facility.